DEFINING DESIGN

QUALITY

90

Notes to the Financial Statements

31 December 2014

30.

Financial instruments: information on financial risks (cont’d)

Financial risk management (cont’d)

Interest rate risk

The Group’s exposure to interest rate risk relates primarily to interest-earning financial assets and interest-bearing

financial liabilities. Interest rate risk is managed by the Group on an on-going basis with the primary objective of

limiting the extent to which net interest expense could be affected by an adverse movement in interest rates.

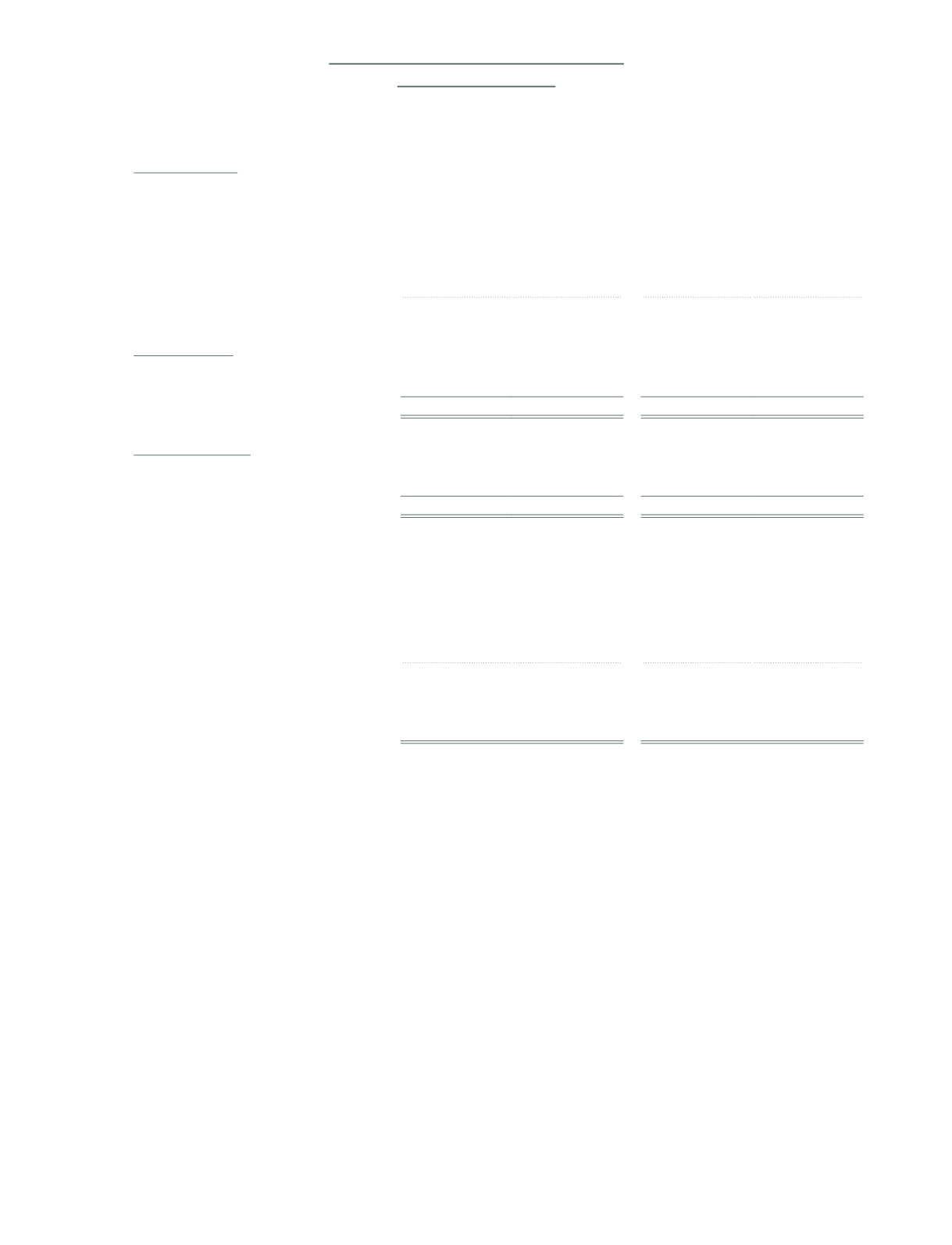

The interest rate risk exposure is from changes in fixed and floating interest rates. The breakdown of the significant

financial instruments by type of interest rate is as follows:

Group

Company

2014

2013

2014

2013

$’000

$’000

$’000

$’000

Financial assets

Fixed rate

24,948

16,647

2,641

2,635

Floating rate

51,874

40,810

5,474

4,071

76,822

57,457

8,115

6,706

Financial liabilities

Fixed rate

33

1,086

–

–

Floating rate

6,481

4,489

–

–

6,514

5,575

–

–

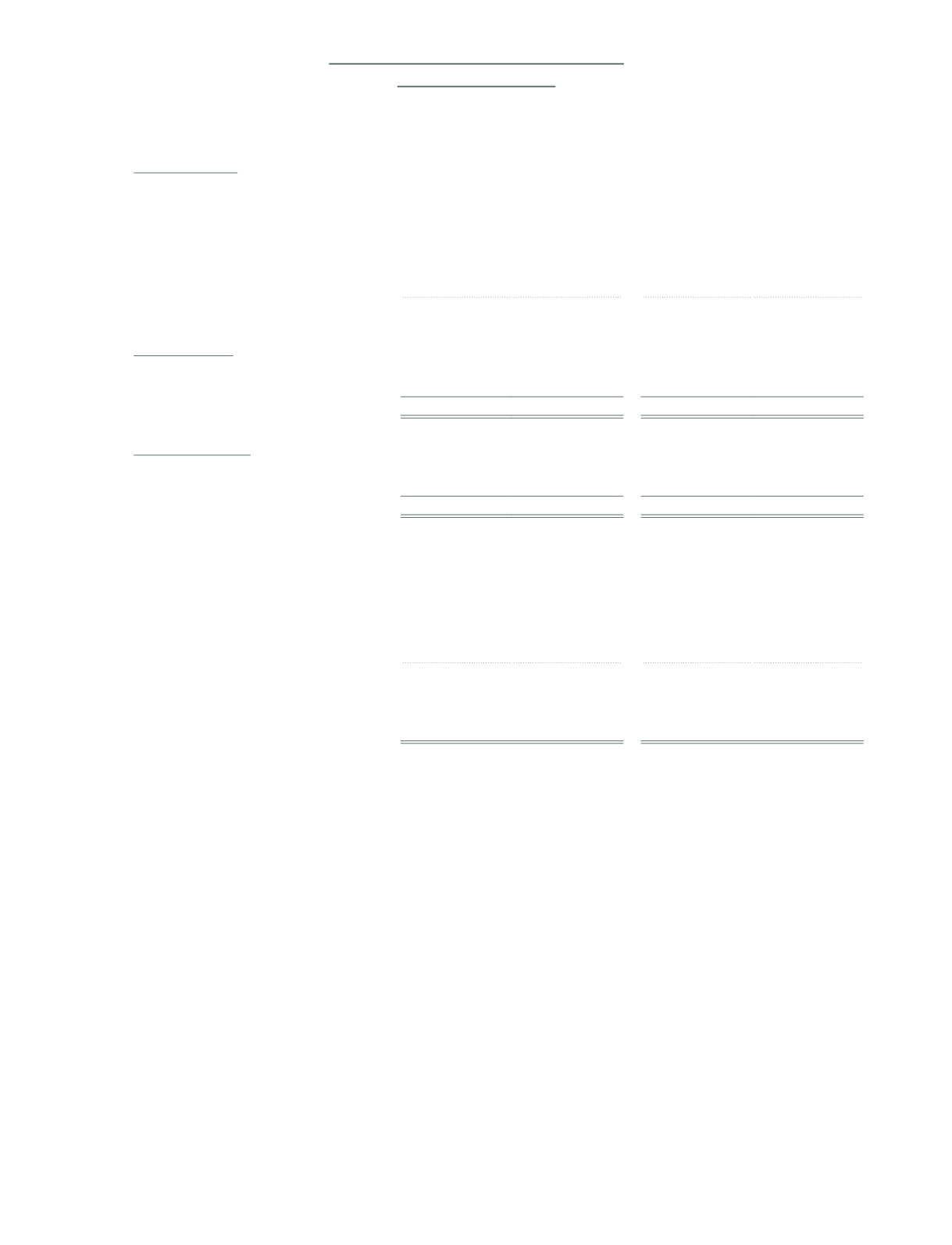

Sensitivity analysis

For the floating rate financial assets and liabilities, a hypothetical increase of 100 (2013: 100) basis points in interest

rate at the end of the reporting year would increase/(decrease) pre-tax profit for the reporting year by the amounts

shown below. A decrease of 100 (2013: 100) basis points in interest rate would have an equal but opposite effect. This

analysis assumes all other variables remain constant.

Group

Company

2014

2013

2014

2013

$’000

$’000

$’000

$’000

Pre-tax profit for the reporting year

454

363

55

41

The hypothetical changes in basis points are not based on observable market data (unobservable inputs).