DEFINING DESIGN

QUALITY

86

Notes to the Financial Statements

31 December 2014

`27. Other financial liabilities (cont’d)

MYR term loan at BECOF + 1.5% p.a.

The MYR term loan at BECOF + 1.5% p.a. is denominated in MYR, bears interest at bank effective cost of funds

(“BECOF”) + 1.5% (2013: BECOF + 1.5%) per annum and is fully repayable by 2031. The loan is secured by a first

mortgage over freehold land and building with an aggregate net carrying amount of $2,014,000 (2013: $2,072,000),

corporate guarantees given by the Company and a subsidiary, Kingsmen Sdn Bhd and personal guarantees given by

certain directors of a subsidiary, Kingsmen Designers & Producers Sdn Bhd.

VND term loans at BLR + 2% p.a.

The Vietnam Dong (“VND”) term loans at BLR + 2% p.a. are denominated in VND, bear interest at BLR + 2% (2013: BLR

+ 2%) per annum and are fully repayable in 2015. The loans are secured by a corporate guarantee of the Company.

Finance leases

The Group has finance leases for certain motor vehicles. There are no restrictions placed upon the Group by entering

into these leases. The lease terms of such finance lease obligations range from 1 to 3 (2013: 1 to 4) years. The average

effective interest rate implicit in the finance lease obligations is 8.10% (2013: 4.58%) per annum. The outstanding

amount of finance lease obligations is secured by way of legal mortgages on the underlying leased assets (Note 13).

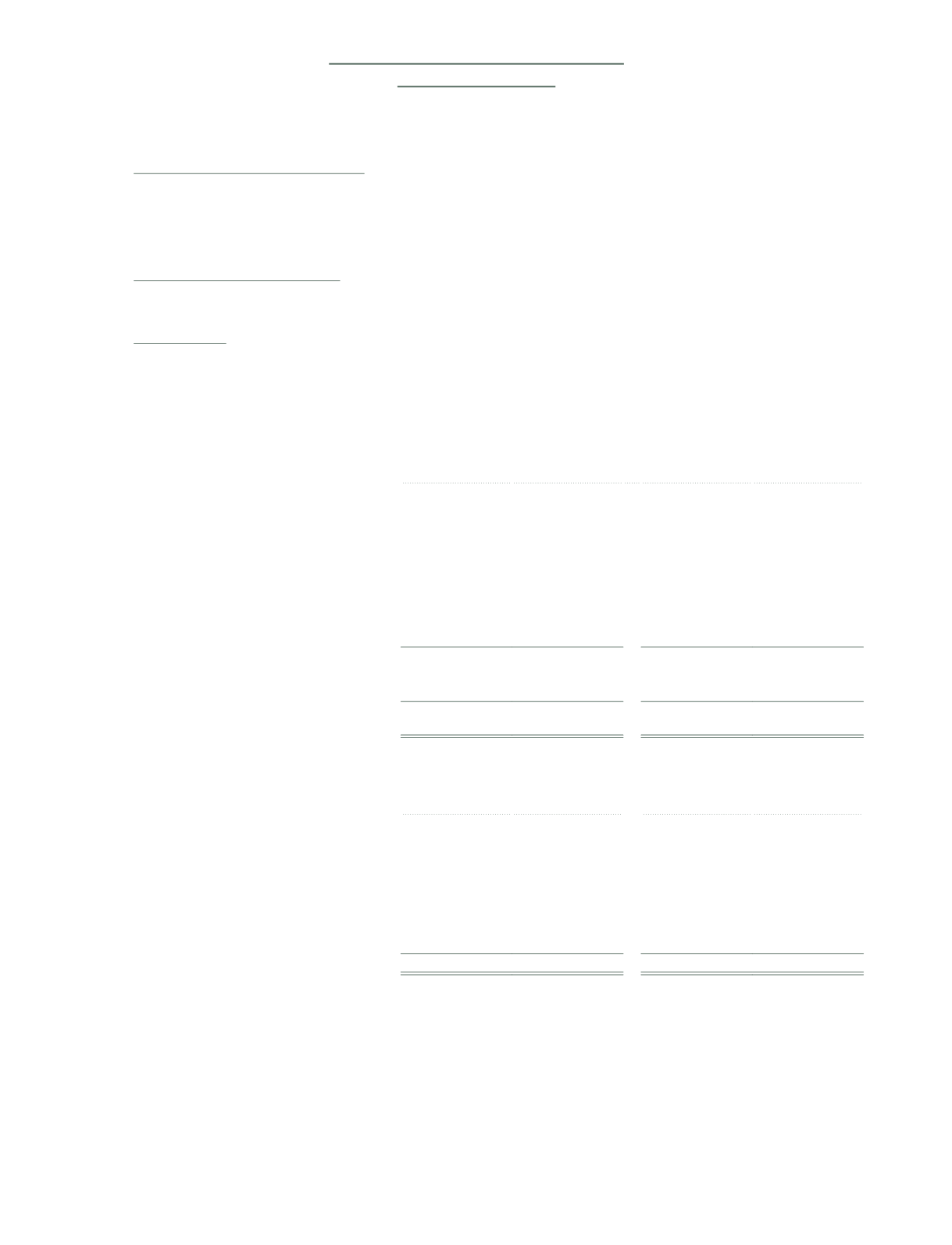

Future minimum lease payments under finance leases together with the present value of the net minimum lease

payments are as follows:

Group

2014

2013

Minimum

lease

payments

Present

value of

payments

Minimum

lease

payments

Present

value of

payments

$’000

$’000

$’000

$’000

Not later than one year

20

18

45

41

Later than one year and not later

than five years

16

15

36

32

Total minimum lease payments

36

33

81

73

Less: Amounts representing

finance charges

(3)

–

(8)

–

Present value of minimum lease

payments

33

33

73

73

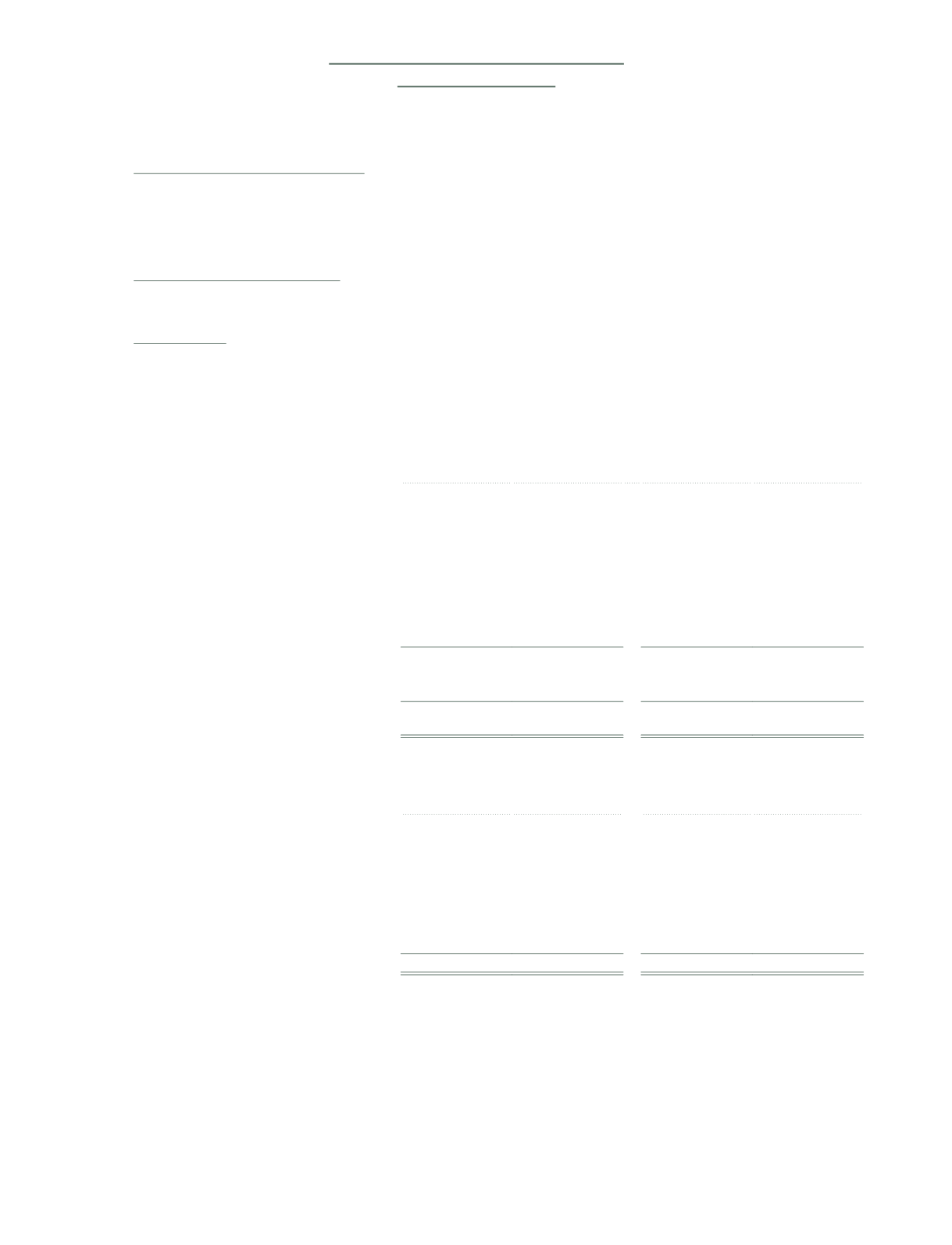

28.

Other liabilities

Group

Company

2014

2013

2014

2013

$’000

$’000

$’000

$’000

Deferred income comprising:

- Advance billings receivable

624

2,828

–

–

- Advance billings received

–

42

–

–

Provision for performance share scheme

1,467

1,167

83

86

2,091

4,037

83

86