DEFINING DESIGN

QUALITY

82

Notes to the Financial Statements

31 December 2014

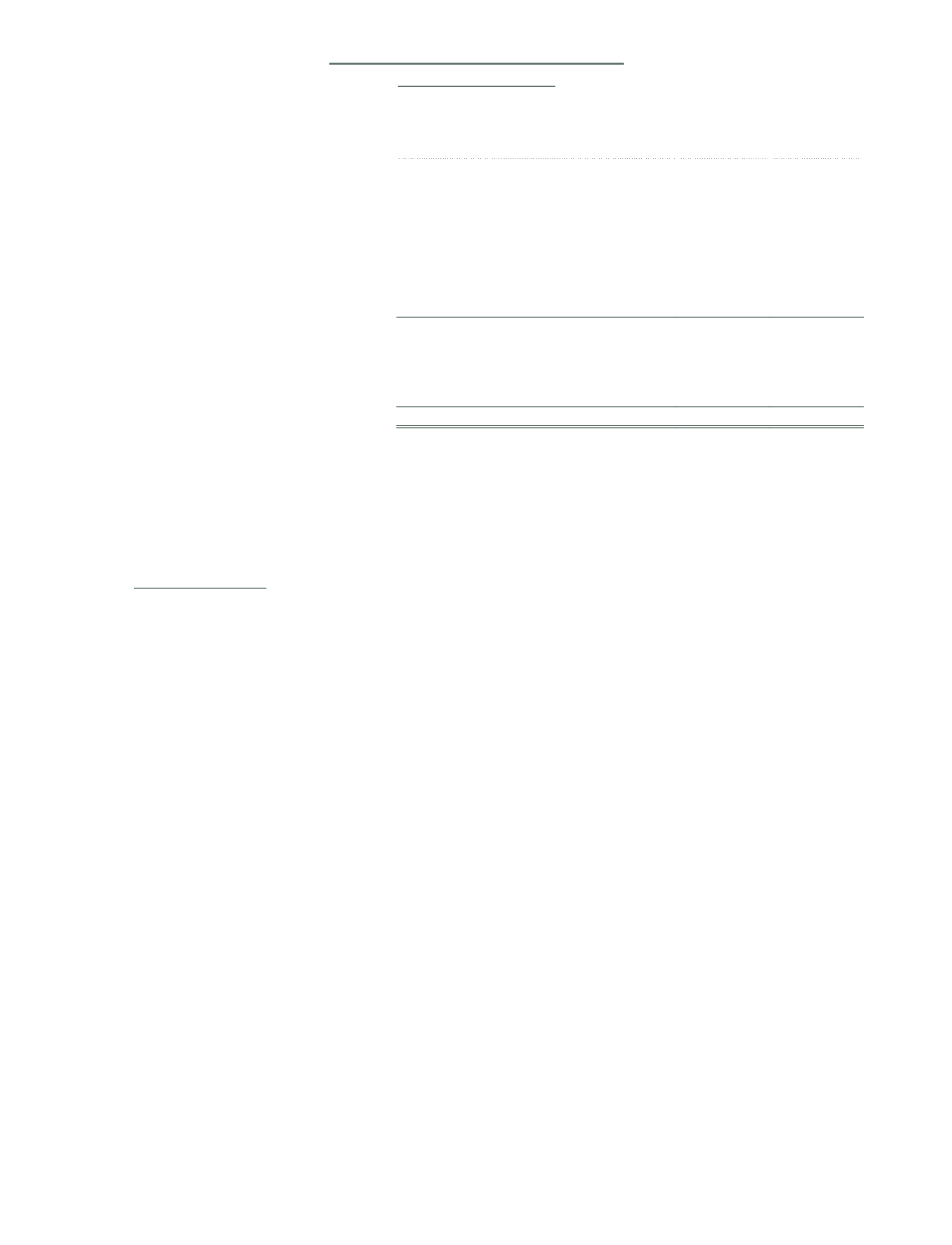

24.

Share capital

Group and Company

Number of

ordinary

shares

issued

Number of

treasury

shares

held

Share

capital

Treasury

shares

Total

$’000

$’000

$’000

At 1 January 2013

194,183,151 (2,537,050)

23,266

(978)

22,288

Reissued pursuant to performance

share scheme

–

1,670,850

–

644

644

At 31 December 2013

194,183,151 (866,200)

23,266

(334)

22,932

Issued pursuant to performance

share scheme

370,110

–

348

–

348

Reissued pursuant to performance

share scheme

–

866,200

–

334

334

At 31 December 2014

194,553,261

–

23,614

–

23,614

The ordinary shares of no par value are fully paid, carry one vote each and have no right to fixed income. The

Company is not subject to any externally imposed capital requirements.

Treasury shares relate to ordinary shares of the Company that are held by the Company. The Company reissued

866,200 (2013: 1,670,850) treasury shares pursuant to its performance share scheme at an average fair value of

$0.929 (2013: $0.884) per share.

Capital management

The objectives when managing capital are to safeguard the Group’s ability to continue as a going concern, so that it

can continue to provide returns for owners and benefits for other stakeholders, and to provide an adequate return

to owners by pricing the sales commensurately with the level of risk. The management sets the amount of capital

to meet its requirements and the risks taken. There were no changes in the approach to capital management during

the reporting year. The management manages the capital structure and makes adjustments to it where necessary or

possible in the light of changes in conditions and the risk characteristics of the underlying assets. In order to maintain

or adjust the capital structure, the management may adjust the amount of dividends paid to owners, return capital

to owners, issue new shares, or sell assets to reduce debt. Adjusted capital comprises all components of equity (that

is, share capital and reserves).

In order to maintain its listing on the Singapore Exchange Securities Trading Limited, the Company has to have share

capital with a free float of at least 10% of the shares. The Company met the capital requirement on its initial listing

and continue to satisfy that requirement, as it did throughout the reporting year. Management receives a report

from the share registrars frequently on substantial share interests showing the non-free float to ensure continuing

compliance with the 10% limit throughout the reporting year.

The management does not set a target level of gearing but uses capital appropriately to support its business and

to add value for shareholders. The key discipline adopted is to widen the margin between the return on capital

employed and the cost of that capital.