DEFINING DESIGN

QUALITY

80

19.

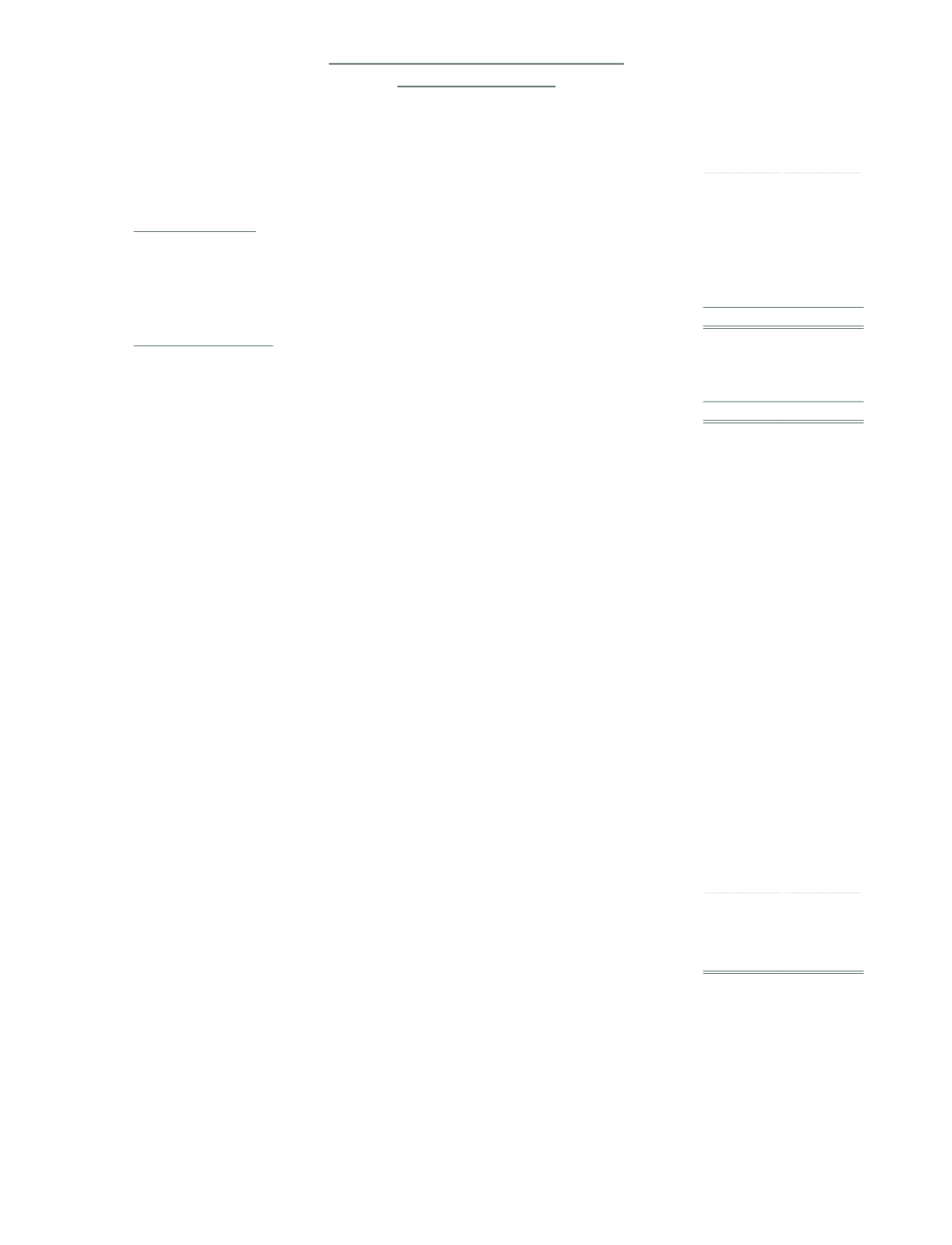

Deferred tax (cont’d)

Statement of

Financial Position

2014

2013

Company

$’000 $’000

Deferred tax assets

Excess of net book value of plant and

equipment over tax values

(40)

–

Provisions

11

–

Unutilised tax losses

202

–

173

–

Deferred tax liabilities

Excess of net book value of plant and

equipment over tax values

–

(38)

Provisions

–

10

–

(28)

Unrecognised tax losses

As at 31 December 2014, the Group has unabsorbed tax losses and unutilised capital allowances totalling $845,000

(2013: $611,000) available for offset against future taxable profits of certain subsidiaries in which the tax losses and

capital allowances arose, for which no deferred tax asset is recognised due to the uncertainty of its recoverability.

These unabsorbed tax losses and unutilised capital allowances are available for offset against future taxable profits

for an unlimited future period except for amounts of $70,000, $129,000, $303,000 and $87,000 (2013: $68,000,

$126,000, $296,000 and $Nil) which expire in the reporting years ending 31 December 2016 to 2019 respectively. The

use of these tax losses and capital allowances is subject to the agreement of the tax authorities and compliance with

certain provisions of the tax legislation in which the subsidiaries operate.

Unrecognised temporary differences relating to investments in subsidiaries

Deferred tax liabilities of $331,000 (2013: $271,000) have not been recognised for taxes that would be payable on

the distribution of the undistributed earnings of certain subsidiaries for the reporting year ended 31 December 2014

as the Group has determined that the undistributed earnings of these subsidiaries will not be distributed in the

foreseeable future.

Tax consequences of proposed dividends

There are no income tax consequences attached to the dividends to the shareholders of the Company of $4,864,000

(2013: $4,833,000) proposed by the Company but not recognised as a liability in the financial statements as at the

end of the reporting year (Note 29).

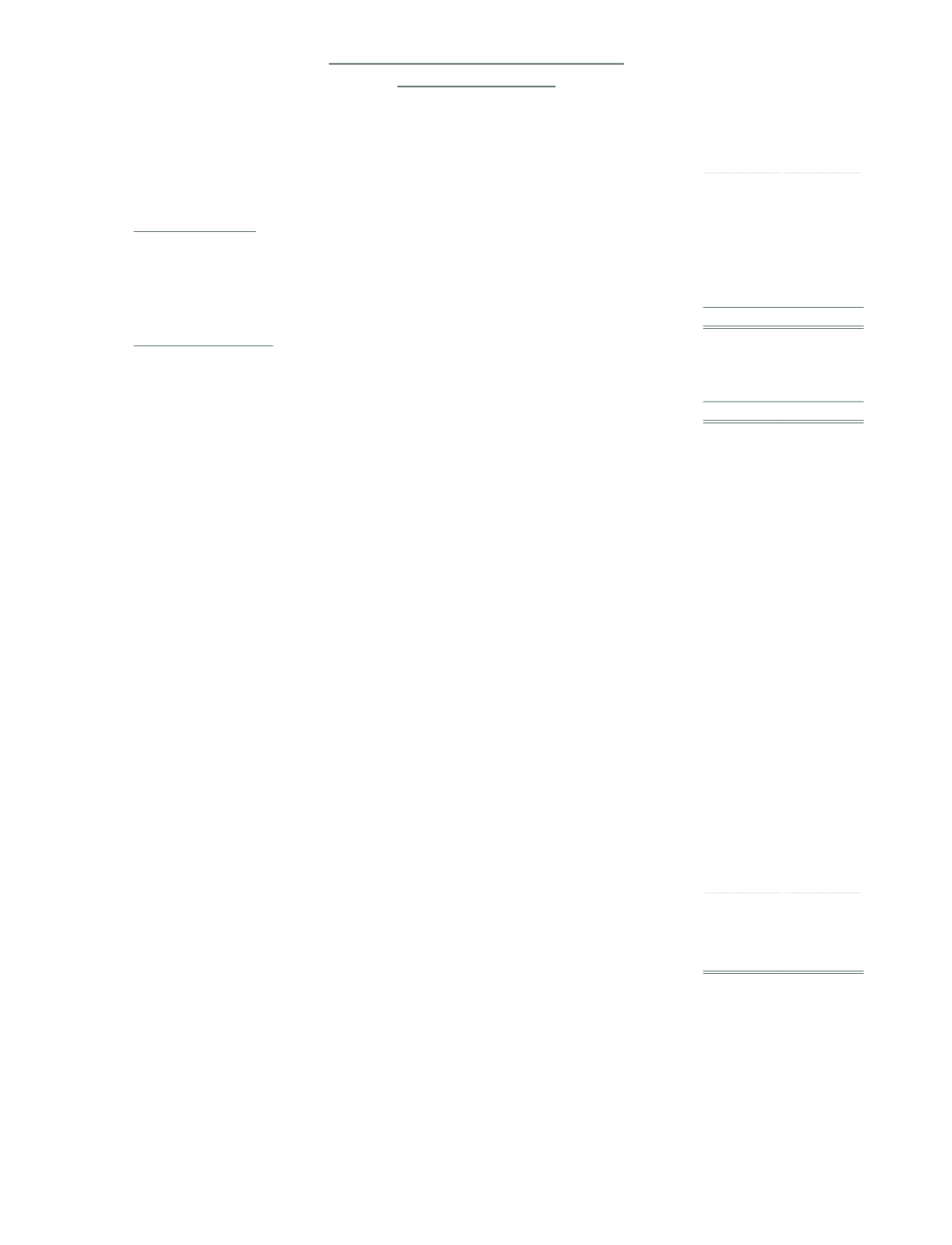

20.

Inventories

Group

2014

2013

$’000 $’000

Project materials

2,182

1,561

Project materials recognised as cost of sales during the reporting year amounted to $907,000 (2013: $1,434,000).

Notes to the Financial Statements

31 December 2014