KINGSMEN CREATIVES LTD

ANNUAL REPORT

2014

89

Notes to the Financial Statements

31 December 2014

30.

Financial instruments: information on financial risks (cont’d)

Financial risk management (cont’d)

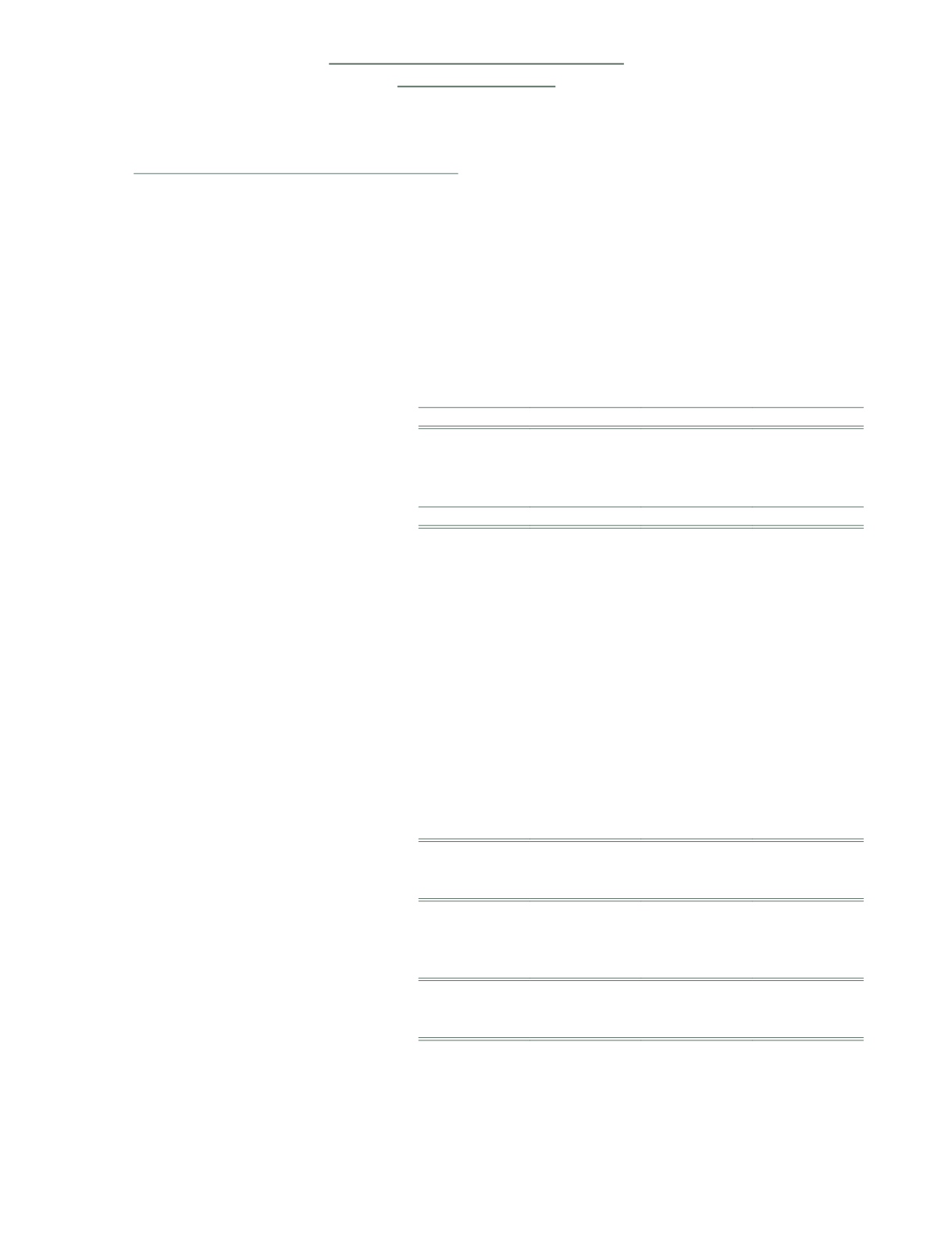

Liquidity risk – financial liabilities maturity analysis

Liquidity risk is the risk that the Group will encounter difficulty in meeting the obligations associated with its financial

liabilities that are settled by delivering cash or another financial asset. The Group’s approach to managing liquidity

is to ensure, as far as possible, that it will always have sufficient liquidity to meet its liabilities when due, under both

normal and stressed conditions, without incurring unacceptable losses or risking damages to the Group’s reputation.

The following tables analyse the financial liabilities by remaining contractual maturity (contractual and undiscounted

cash flows) at the end of the reporting year:

Due less

than 1 year

Due within

2 – 5 years

Due after

5 years

Total

Group

$’000

$’000

$’000

$’000

2014

Trade and other payables

99,560

154

–

99,714

Other financial liabilities

5,424

559

1,518

7,501

At end of the year

104,984

713

1,518

107,215

2013

Trade and other payables

97,955

119

–

98,074

Other financial liabilities

3,418

586

1,732

5,736

At end of the year

101,373

705

1,732

103,810

The Company’s financial liabilities consist only of trade and other payables which have a contractual maturity

of within one year. The undiscounted cash flows of the trade and other payables amounted to $1,642,000 (2013:

$1,442,000).

The undiscounted amounts on the other financial liabilities with fixed and floating interest rates are determined by

reference to the conditions existing at the end of the reporting year.

It is expected that all the liabilities will be settled at their contractual maturity. The credit period taken to settle trade

payables is generally between 30 to 90 (2013: 30 to 90) days. Other payables are with short-term durations. In order

to meet such cash commitments, the operating activities are expected to generate sufficient cash inflows.

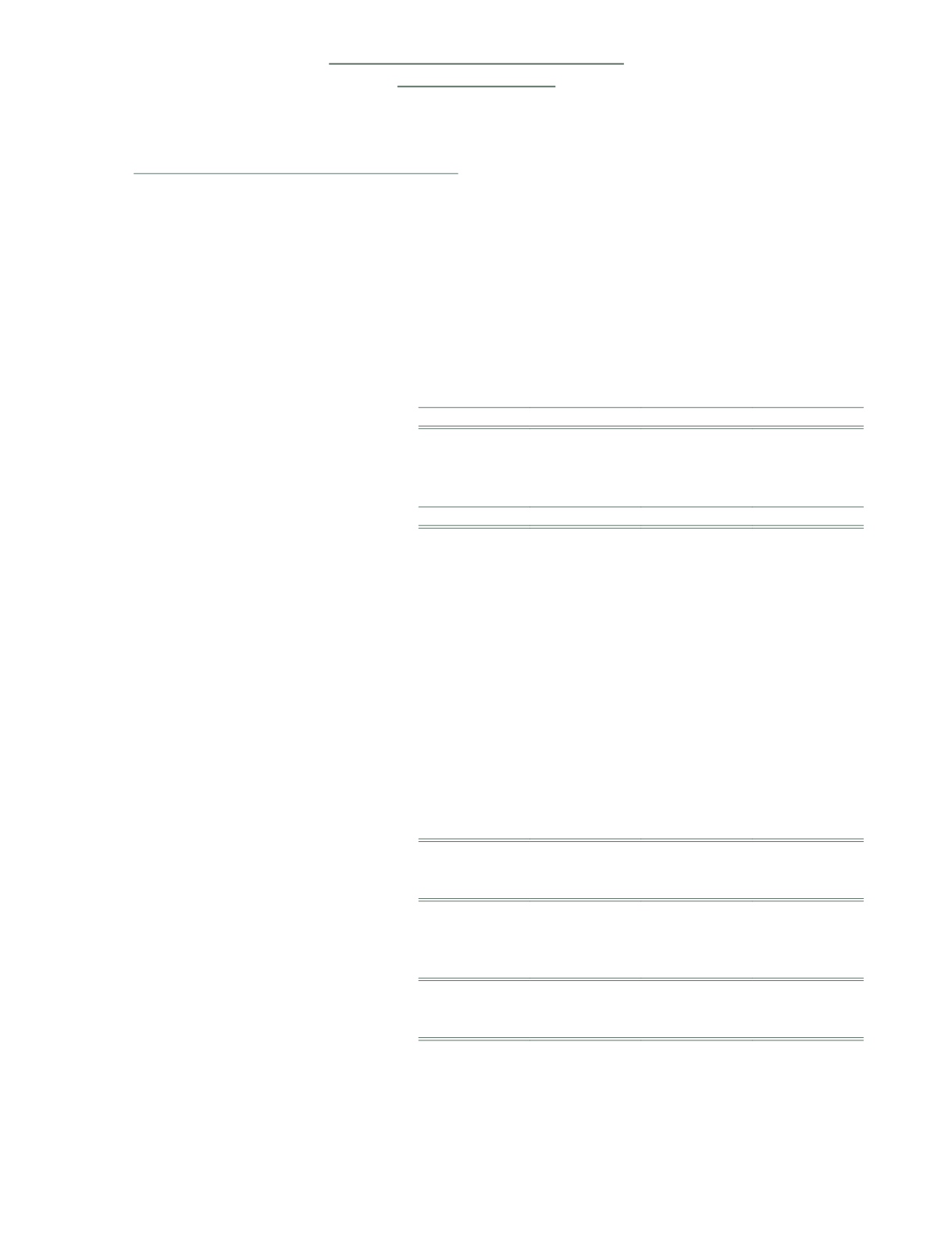

The following tables analyse the financial guarantee contracts based on the earliest dates in which the maximum

guaranteed amount could be drawn upon:

Due less

than 1 year

Due within

2 – 5 years

Due after

5 years

Total

Group

$’000

$’000

$’000

$’000

2014

Financial guarantee contracts

22,625

3,763

1,446

27,834

2013

Financial guarantee contracts

15,133

3,788

1,494

20,415

Company

2014

Financial guarantee contracts

20,920

3,763

1,446

26,129

2013

Financial guarantee contracts

13,349

3,788

1,494

18,631

As at the end of the reporting year, no claims on the financial guarantee contracts are expected.