DEFINING DESIGN

QUALITY

88

Notes to the Financial Statements

31 December 2014

30.

Financial instruments: information on financial risks (cont’d)

Financial risk management

The main purpose for holding or issuing financial instruments is to raise and manage the finances for the Group’s

operating, investing and financing activities. There are exposures to the financial risks on the financial instruments

such as credit risk, liquidity risk and market risk comprising interest rate risk, foreign currency risk and equity price

risk. Management has certain practices for the management of these financial risks. All financial risk management

activities are carried out based on good market practices and are monitored by management staff. The Group’s

overall financial risk management strategy seeks to minimise the potential material adverse effects from these

financial risk exposures. The information about the Group’s exposure to each of the above risks and the Group’s

objectives, policies and processes for measuring and managing these risks are presented below. There has been no

change to the Group’s exposure to these financial risks or the manner in which it manages and measures these risks.

Credit risk on financial assets

Credit risk is the risk of financial loss to theGroup if a counterparty to a financial instrument fails tomeet its contractual

obligations and arises principally from the Group’s cash and cash equivalents, trade and other receivables and other

investments. The maximum exposure to credit risk is the total of the fair values of the financial instruments.

Credit risk on cash balances with banks and financial institutions, other receivables and other investments is limited

because the counterparties are entities with acceptable credit ratings. Note 23 discloses the maturity of the cash

and cash equivalents balances. Other receivables are normally with no fixed terms and therefore there is no maturity.

Note 17 discloses the maturity of the other investments balances.

For credit risk on trade receivables, an ongoing credit evaluation is performed on the financial condition of the

debtors and an impairment loss is recognised in profit or loss where necessary. The Group’s exposure to credit risk on

trade receivables is controlled by setting limits on the exposure to individual customers and these are disseminated

to the relevant persons concerned and compliance is monitored by management. Other than as disclosed below,

there is no significant concentration of credit risk on trade receivables as the exposure is spread over a large number

of customers. As part of the process of setting customer credit limits, different credit terms are used. The credit

period granted to customers is generally between 60 to 90 (2013: 60 to 90) days.

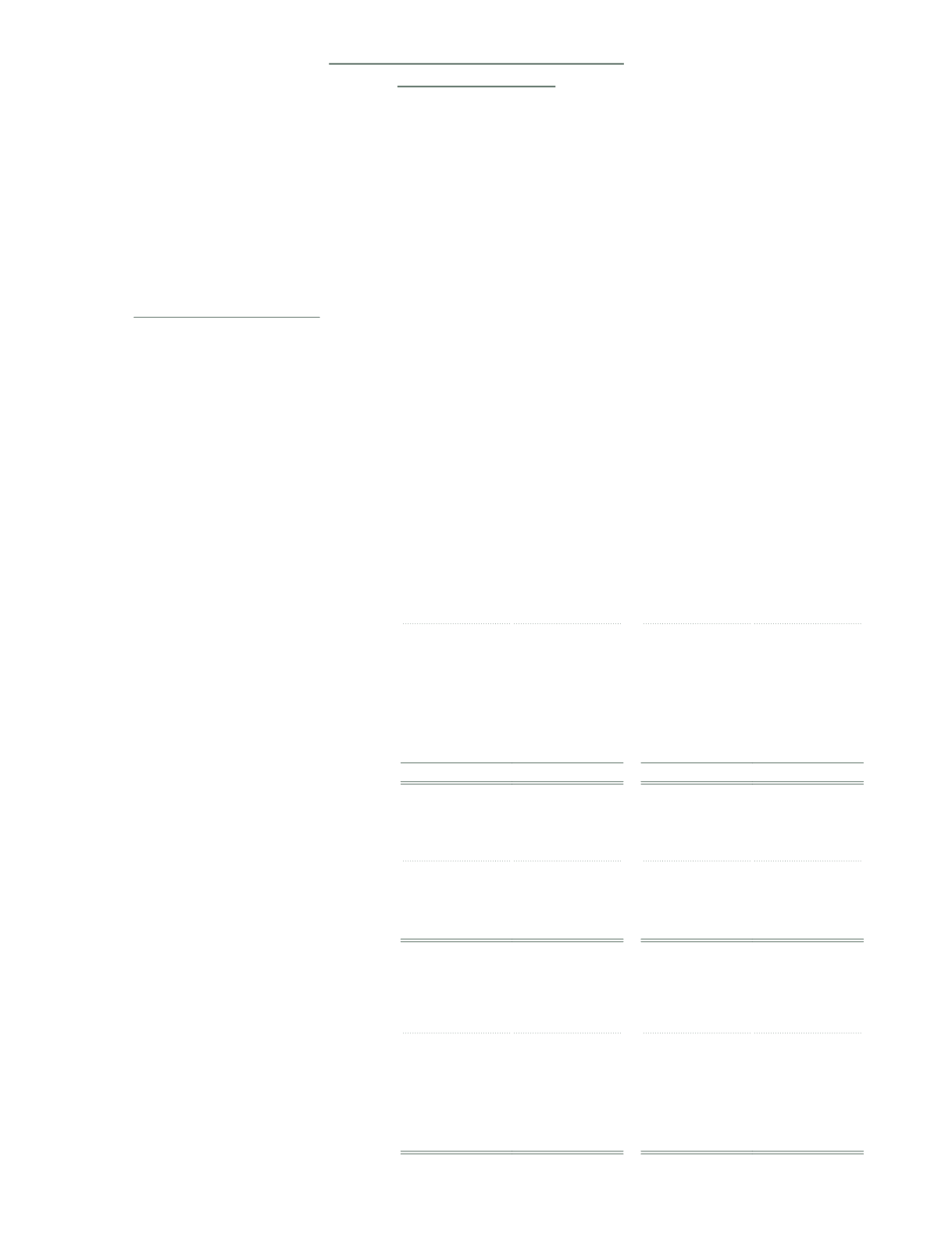

Ageing analysis of trade receivables that are past due as at the end of the reporting year but not impaired is as

follows:

Group

Company

2014

2013

2014

2013

$’000

$’000

$’000

$’000

Past due less than 30 days

4,725

2,347

–

59

Past due 31 to 60 days

2,002

1,575

–

–

Past due 61 to 90 days

1,216

818

268

394

Past due over 90 days

8,291

9,015

68

337

16,234

13,755

336

790

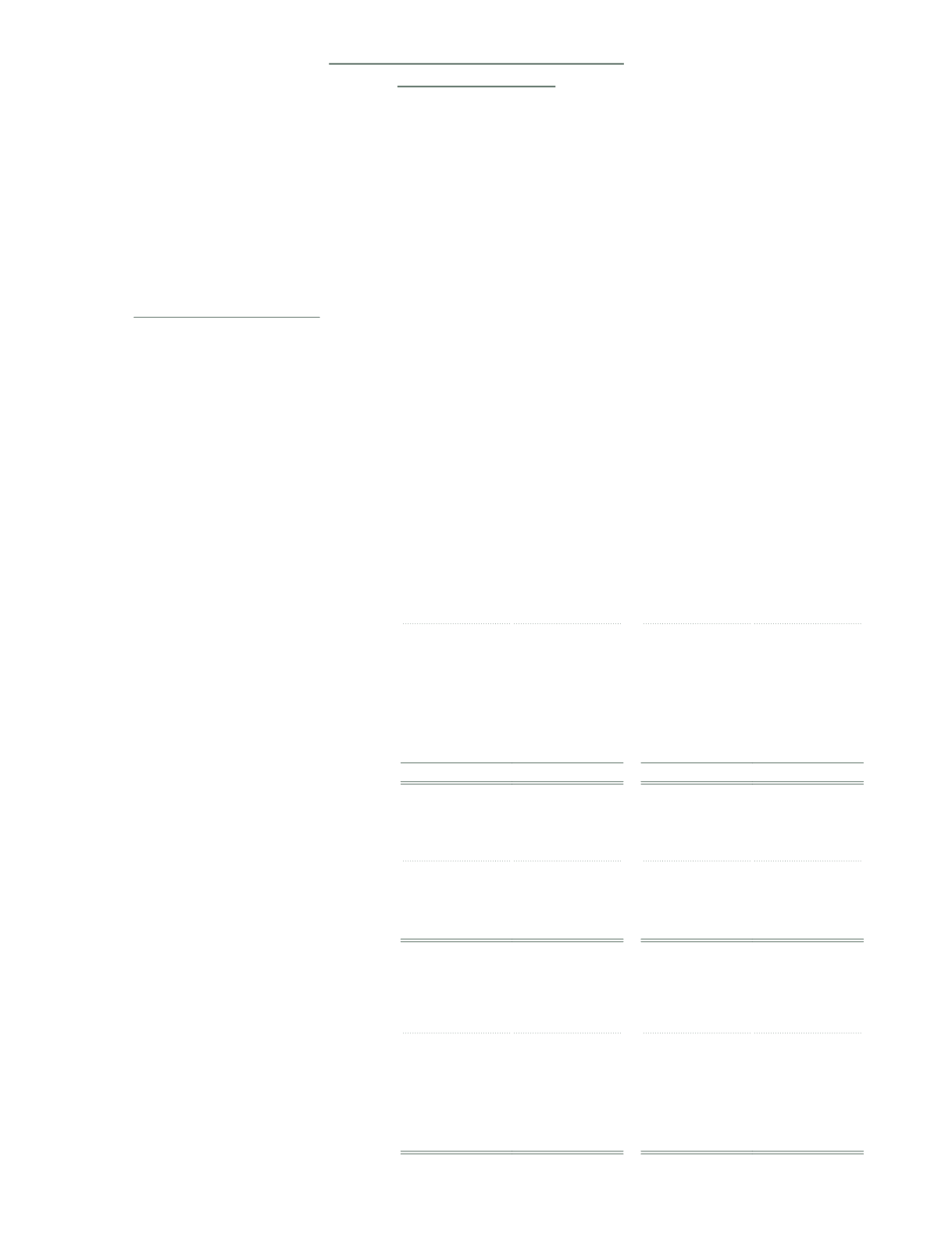

Ageing analysis of trade receivables as at the end of the reporting year that are impaired is as follows:

Group

Company

2014

2013

2014

2013

$’000

$’000

$’000

$’000

Past due over 365 days

1,065

771

–

–

At the end of the reporting year, approximately 19% (2013: 18%) and 45% (2013: 48%) of the Group and the Company’s

trade receivables are due from three customers as follows:

Group

Company

2014

2013

2014

2013

$’000

$’000

$’000

$’000

Top 1 customer

8,119

9,112

182

353

Top 2 customer

4,561

3,786

120

170

Top 3 customer

2,315

3,593

92

154