DEFINING DESIGN

QUALITY

92

Notes to the Financial Statements

31 December 2014

30.

Financial instruments: information on financial risks (cont’d)

Financial risk management (cont’d)

Foreign currency risk (cont’d)

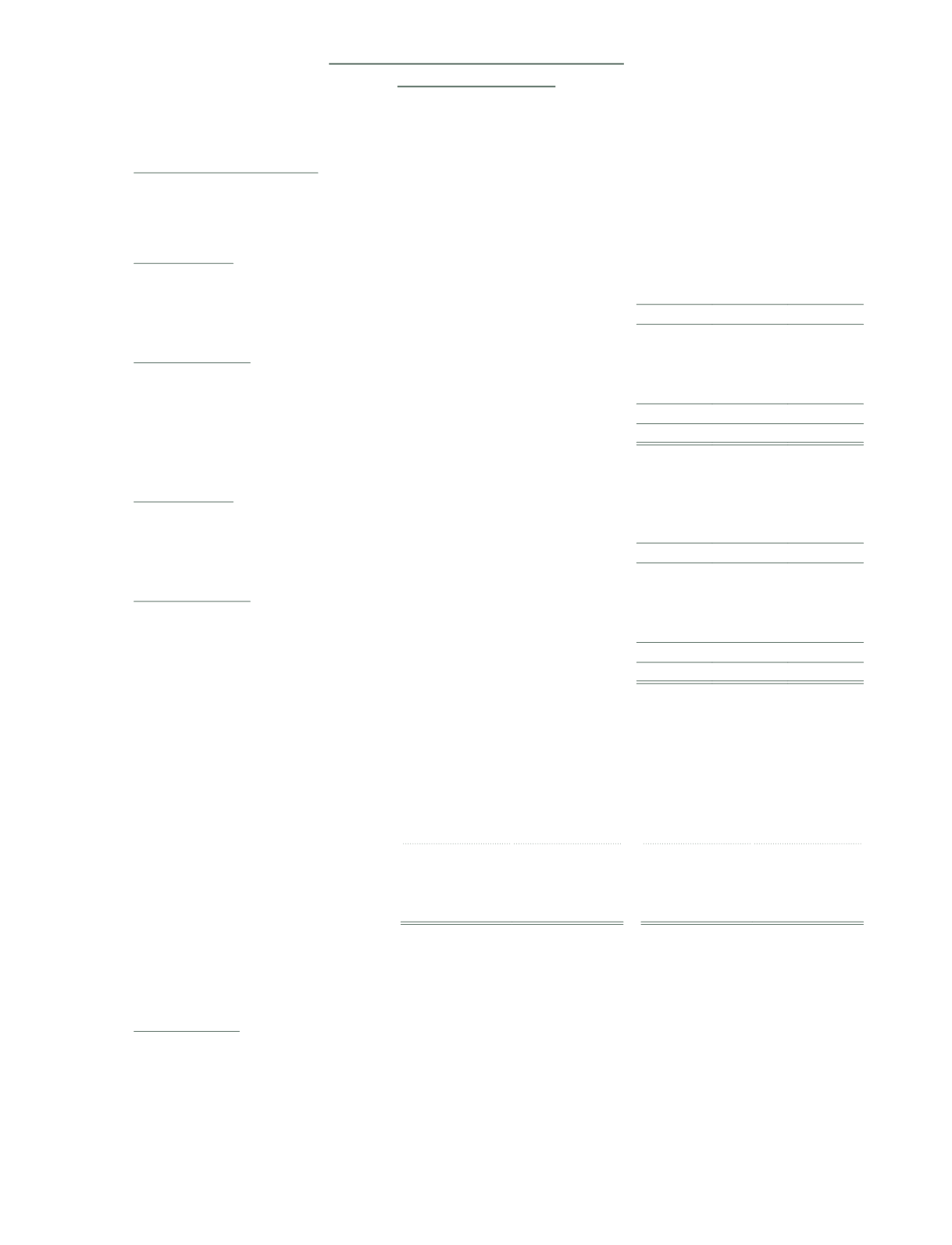

USD MYR Total

Company

$’000 $’000 $’000

2014

Financial assets

Trade and other receivables

324

66

390

Cash and cash equivalents

–

–

–

Total financial assets

324

66

390

Financial liabilities

Trade and other payables

–

–

–

Other financial liabilities

–

–

–

Total financial liabilities

–

–

–

Net financial assets

324

66

390

2013

Financial assets

Trade and other receivables

445

100

545

Cash and cash equivalents

–

–

–

Total financial assets

445

100

545

Financial liabilities

Trade and other payables

–

–

–

Other financial liabilities

–

–

–

Total financial liabilities

–

–

–

Net financial assets

445

100

545

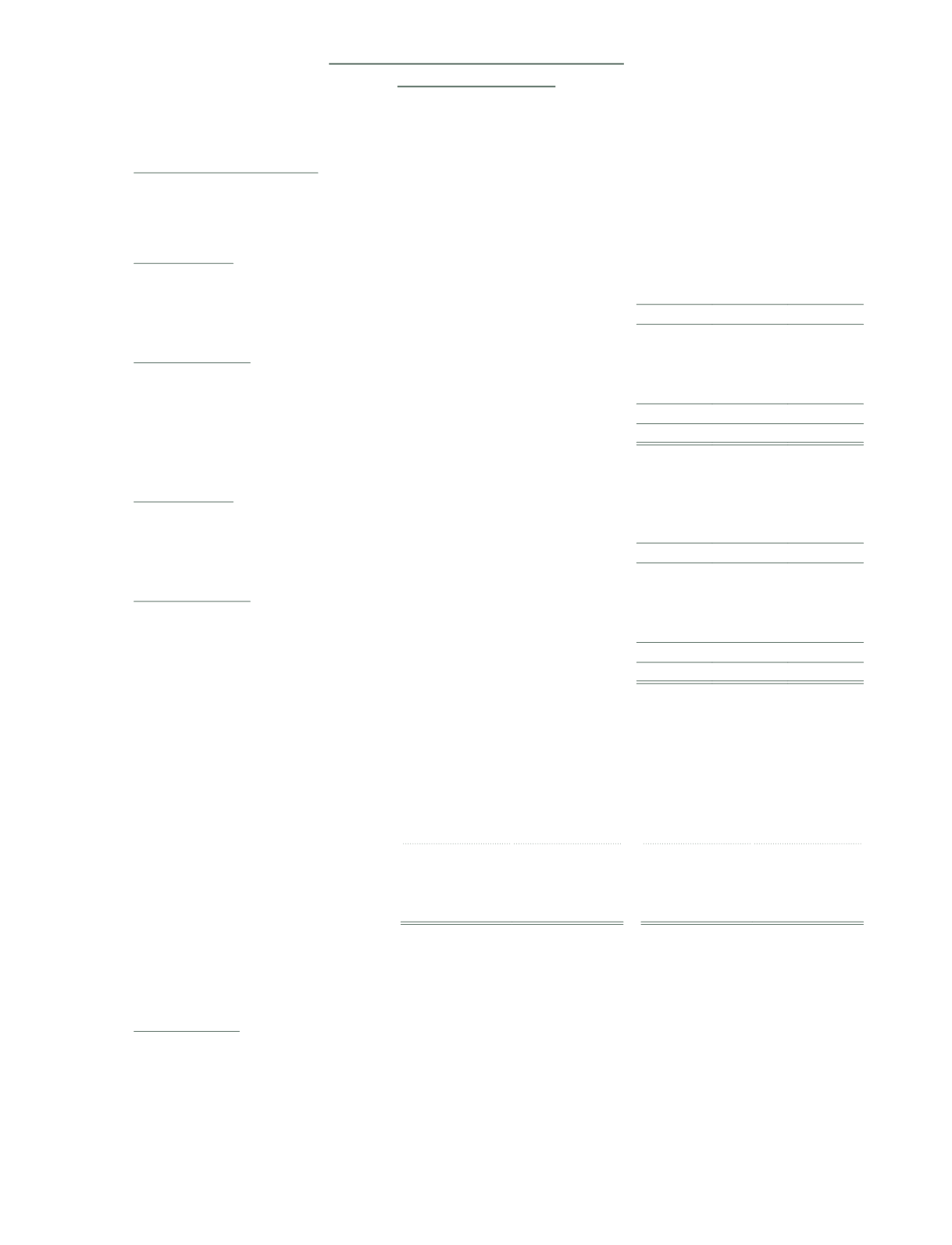

Sensitivity analysis

A hypothetical 3% (2013: 3%) strengthening of the above currencies against the functional currency of the respective

entities of the Group at the end of the reporting year would increase/(decrease) pre-tax profit for the reporting year

by the amounts shown below. A 3% (2013: 3%) weakening of the above currencies against the functional currency

of the respective entities of the Group would have an equal but opposite effect. This analysis has been carried out

without taking into consideration of hedged transactions and assumes all other variables remain constant.

Group

Company

2014

2013

2014

2013

$’000

$’000

$’000

$’000

Pre-tax profit for the reporting year

250

301

12

16

The hypothetical sensitivity rate used in the above tables is the reasonably possible change in foreign exchange

rates.

Equity price risk

There are investments in equity shares or similar instruments. As a result, such investments are exposed to both

currency risk and market price risk arising from uncertainties about future values of the investment securities. The

fair values of these assets are disclosed in Note 17.

The sensitivity analysis effect on post-tax profit and other comprehensive income is not significant.