31.

Financial instruments: information on financial risks (cont’d)

Financial risk management (cont’d)

Interest rate risk (cont’d)

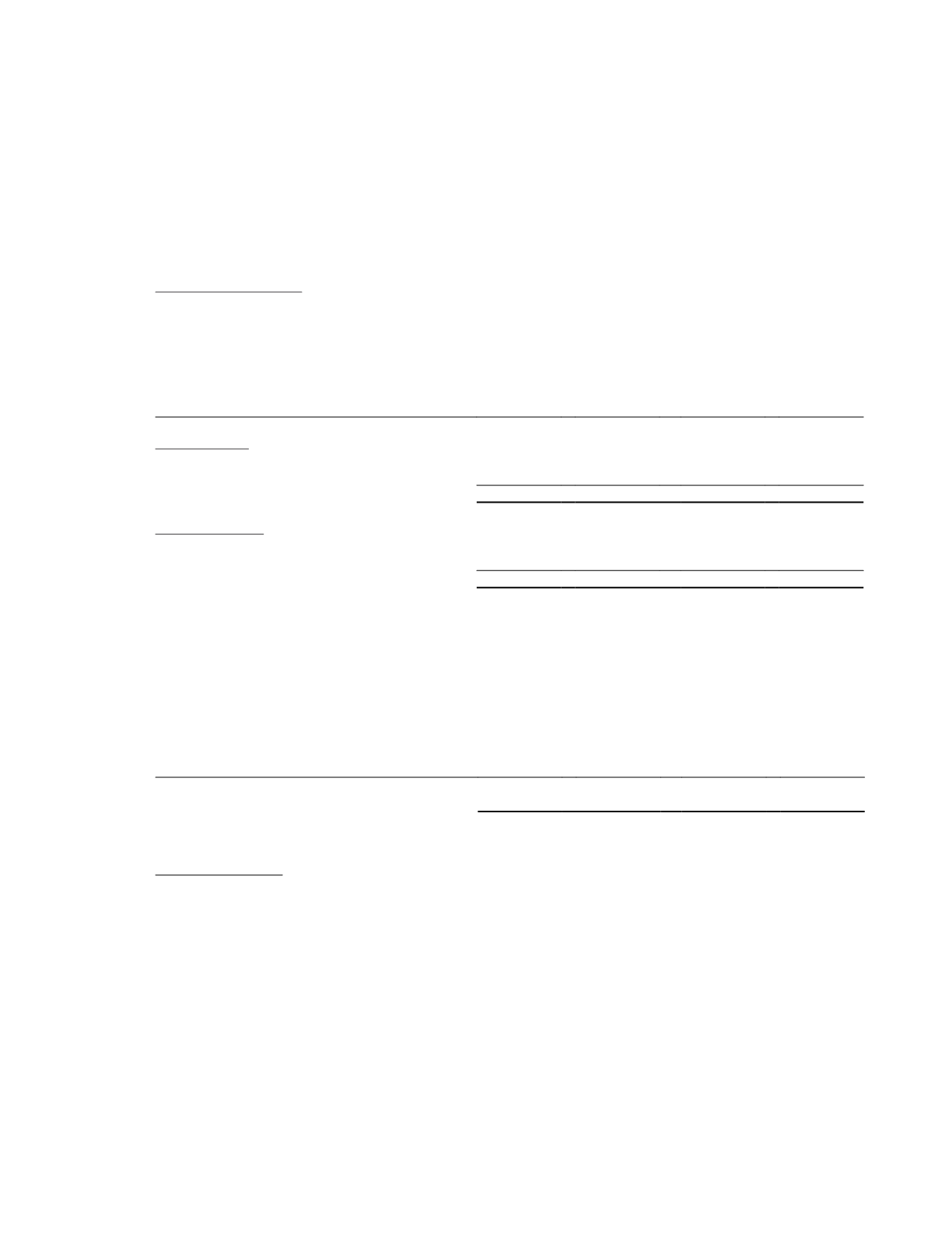

The interest rate risk exposure is from changes in fixed and floating interest rates. The breakdown of the significant

financial instruments by type of interest rate is as follows:

Group

Company

2015

$’000

2014

$’000

2015

$’000

2014

$’000

Financial assets

Fixed rate

9,001

24,948

3,889

2,641

Floating rate

55,942

51,874

2,236

5,474

64,943

76,822

6,125

8,115

Financial liabilities

Fixed rate

4,527

33

–

–

Floating rate

8,858

6,481

–

–

13,385

6,514

–

–

Sensitivity analysis

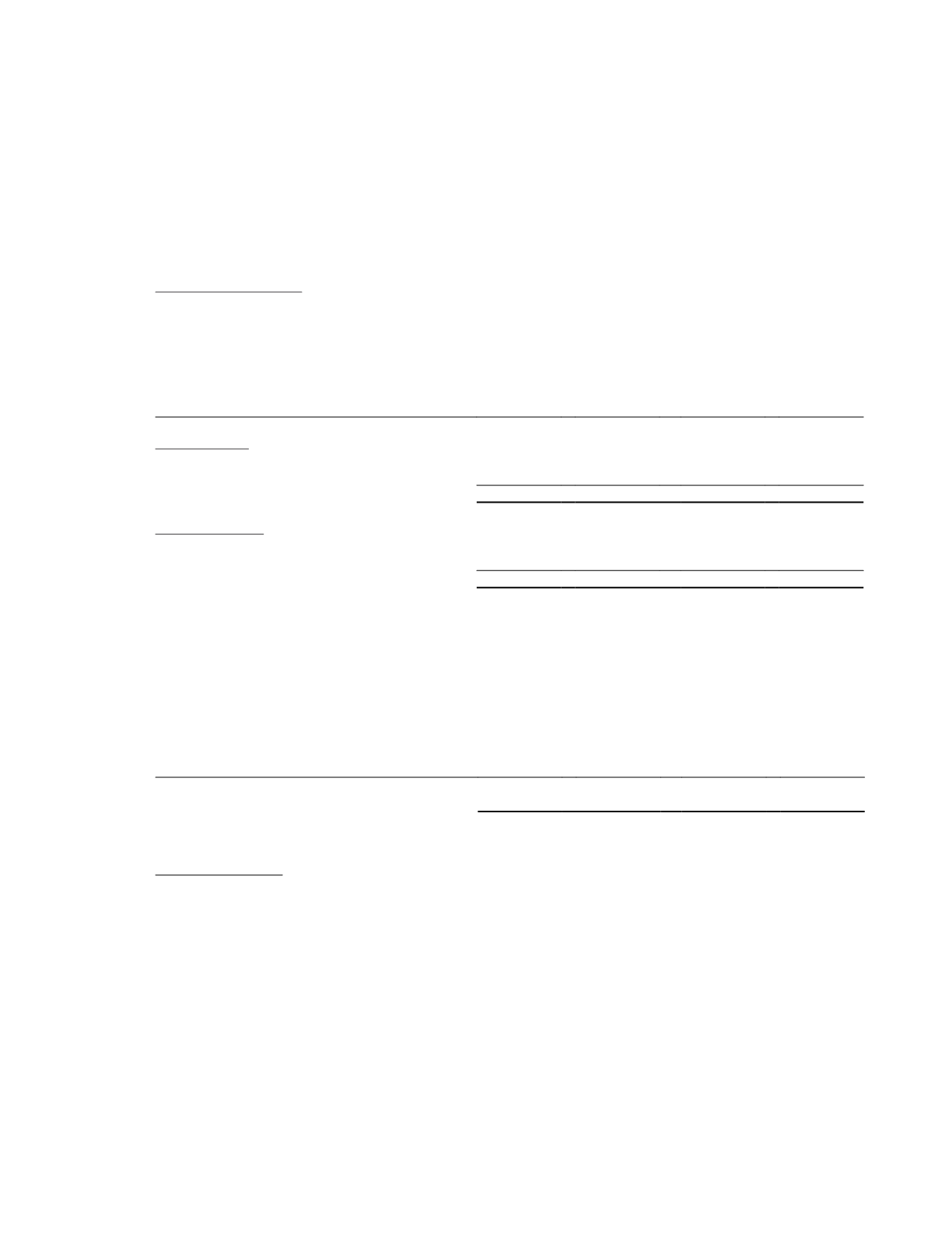

For the floating rate financial assets and liabilities, a hypothetical increase of 100 (2014: 100) basis points in interest rate

at the end of the reporting year would increase pre-tax profit for the reporting year by the amounts shown below. A

decrease of 100 (2014: 100) basis points in interest rate would have an equal but opposite effect. This analysis assumes

all other variables remain constant.

Group

Company

2015

$’000

2014

$’000

2015

$’000

2014

$’000

Pre-tax profit for the reporting year

471

454

22

55

The hypothetical change in basis point is not based on observable market data (unobservable inputs).

Foreign currency risk

The Group has exposure to foreign currency movements on financial assets and financial liabilities denominated in foreign

currencies. It also has exposure on sales and purchases that are denominated in foreign currencies. The currencies

giving rise to the foreign currency risk are primarily the SGD, United States Dollar (“USD”), Hong Kong Dollar (“HKD”),

Thai Baht (“THB”) and China Renminbi (“RMB”). The Group hedges its foreign currency exposure should the need arise

through the use of forward foreign currency contracts.

k i n g s m e n c r e a t i v e s l t d

a n n u a l r e p o r t 2 0 1 5

•

1 0 7