notes to the

financial statements

31 December 2015

31.

Financial instruments: information on financial risks (cont’d)

Financial risk management (cont’d)

Liquidity risk – financial liabilities maturity analysis (cont’d)

It is expected that all the liabilities will be settled at their contractual maturity. The credit period taken to settle trade

payables is generally between 30 to 90 (2014: 30 to 90) days. Other payables are normally with no fixed terms and

therefore there is no maturity. In order to meet such cash commitments, the operating activities are expected to

generate sufficient cash inflows.

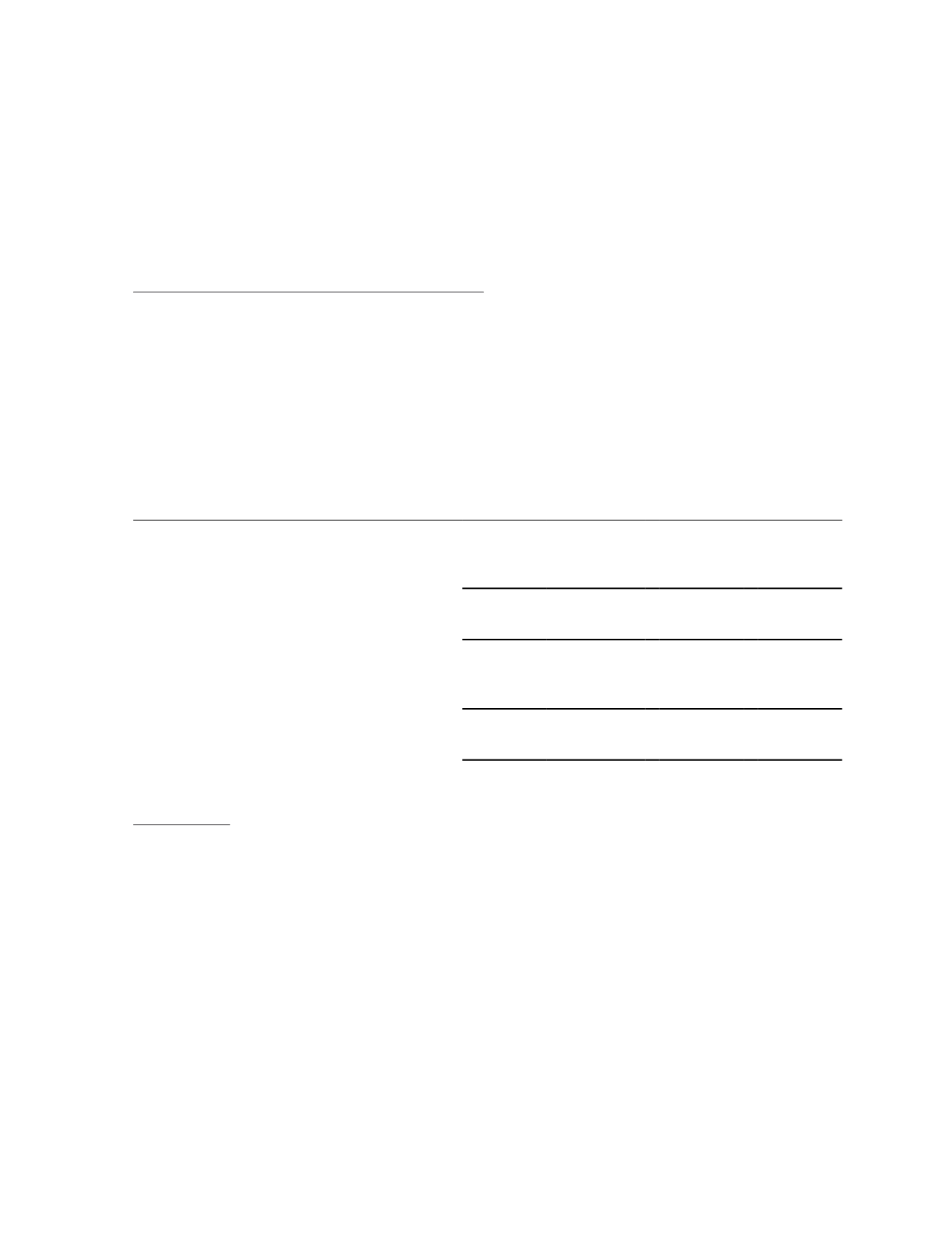

The following tables analyse the financial guarantee contracts based on the earliest dates in which the maximum

guaranteed amount could be drawn upon:

Due

less than

1 year

Due

within

2 – 5 years

Due

after

5 years

Total

$’000

$’000

$’000

$’000

Group

2015

Financial guarantee contracts

20,172

10,875

2,749

33,796

2014

Financial guarantee contracts

22,625

3,763

1,446

27,834

Company

2015

Financial guarantee contracts

18,732

10,875

2,749

32,356

2014

Financial guarantee contracts

20,920

3,763

1,446

26,129

As at the end of the reporting year, no claims on the financial guarantee contracts are expected.

Interest rate risk

The Group’s exposure to interest rate risk relates primarily to interest-earning financial assets and interest-bearing

financial liabilities. Interest rate risk is managed by the Group on an on-going basis with the primary objective of limiting

the extent to which net interest expense could be affected by an adverse movement in interest rates.

• e x p e r i e n c i n g

k i n g s m e n

1 0 6