Dear Investors,

Thank you very much for the questions and the opportunity for us to respond. We hope you have a better understanding of our business through this online exchange. Your questions will be reposted in blue followed by our replies in black.

Warmest regards,

The Management Team

Kingsmen Creatives Ltd

|

|

Dear Jayster, you wrote:

Any plans to expand into the middle east like the UAE? They are using their "oil money" to build mega convention centre & shopping malls. Margins should be higher there too, any comments on the prospect there? Thanks

Yes, it is our intention to expand into the Middle East.

Kingsmen Middle East (L.L.C.) was set up in Dubai in 2002. However, this company, and a few other companies (collective known as the Kingsmen Affiliates) was excluded from the listed Group at the time of the IPO exercise. The shareholdings in these Kingsmen Affiliates were retained by Kingsmen International Pte Ltd (which is 100% owned by our controlling shareholders and executive directors).

Kingsmen Creatives Ltd was granted call options to acquire the respective interest of the controlling shareholders and executive directors in the share capital of the Kingsmen Affiliates. (For more details with regards to the call options, please refer to Page 112 of our IPO prospectus)

We are optimistic about the prospect in the Middle East, and our Kingsmen Affiliate there has shown positive results in FY2005. We are expecting to exercise the call option to acquire the shares in Kingsmen Middle East (L.L.C.) at an appropriate time in the medium-term future.

Warmest regards,

The Management Team

Kingsmen Creatives Ltd

|

|

Dear Tan Kim Seng, you wrote:

Is Kingsmen involved in the development of the Integrated Resorts being built in Singapore? What opportunities & threats do Kingsmen see in this development?

The development of the Integrated Resort ("IR") in Singapore is excellent news to us as the IR will create a host of potential contracts for interior works, theme decorations and retail interiors. In addition, our services may be required when the resorts are operational and events and exhibitions are held there.

At this moment, we are not involved in the development or construction of the IR. In due course, we do expect ourselves to be heavily involved in interior fit-out works for the IR as we have been informally consulted with regards to these opportunities.

Warmest regards,

The Management Team

Kingsmen Creatives Ltd

|

|

Dear Joanne Lee, you wrote:

Your share price haven't moved much since your announcement of the S$30 Million order book. I suspect its your small float on the open market, any plans in increase the liquidity of your counter.

Yes, we do have plans to increase the liquidity of our counter when the opportunity or need arises.

Warmest regards,

The Management Team

Kingsmen Creatives Ltd

|

|

Dear Yang You Lee, you wrote:

I've been to exhibition booth done by your company. What do you do to the fittings after the exhibition end? Do you recycle it or throw it away? Do the vendors keep it or do you use it as a showcase?

With regards to the exhibition booths set-up or constructed for our customers, there are typically two types of services which we provide:-

- Designing, fabricating and installing custom-designed or special-designed booths or pavilions of which the construction structures are primarily not re-usable.

- Renting out of exhibition services assets � rental of re-useable and re-configurable exhibition booths which are made from aluminium and stainless steel modular re-configurable structures, panels, joints, struts, beams and columns.

As part of the package for both of our services as described above, we usually provide re-useable furniture and furnishings and electrical installations.

Warmest regards,

The Management Team

Kingsmen Creatives Ltd

|

|

Dear June Tan, you wrote:

What strategy does the company engages in to differentiate itself from its competitors?

The strategies which we use to differentiate ourselves are:-

- Our brand visibility.

- Vertically and horizontally integrated "one-stop-shop".

- Regional presence and global connections.

- Long-standing relationship with clients, who value our professional services. Over 50% of our revenue are from repeat customers.

Warmest regards,

The Management Team

Kingsmen Creatives Ltd

|

|

Dear Kelvin Teo, you wrote:

Hi, i'm in the design industry as well. I find it hard to retain my best designers as mine is a small setup. Any secrets to share in retaining and hiring of staff in the design industry?

We are fortunate to be able to retain many of our staff including our good designers. It is our corporate philosophy that the heart of quality at Kingsmen lies with the people.

In our recruitment and retention of staff, we adopt a set of internal guidelines so that we provide adequate and appropriate training and career advance opportunities for our people.

For interest, you may wish to refer to our Corporate Philosophy at our website at:-

http://www.kingsmen-int.com/

Warmest regards,

The Management Team

Kingsmen Creatives Ltd

|

|

Dear Richchee, you wrote:

Dear management, thanks for this session. Here are my questions that hope you can answer and/ highlight:

Q1) I can imagine that the bi-annual Asian Aerospace show in Singapore provides a good amount of revenue to the company. With the recent announcement that this show will be replaced by the Singapore Air show while the original Asian Aerospaceshow will move to Hong Kong, may I know:

1A) Has the company lost the Asian Aerospace show contract, as the show will now move to Hong Kong? What is the percentage of the total revenue the Asian Aerospace show took up in FY04 revenue?

1B) To date, are you in negotiation to secure the Singapore air show contract? What is the update of this negotiation if there is any?

Q2) What is your target revenue growth for 2006 from 2005?

Q3) The company put out an announcement stating that it has made S$21.2 Million sales as at 22-Feb-06. Then we have a S$30.1 Million confirmed contracts/sales as at 10-Apr-06. Confirmed contracts/sales is a little unclear for me. Are these done sales, ie customers are already billed, or of the S$21.2 Million sales reported earlier, the difference of S$8.9 Million are confirmed contracts but customer(s) are not billed? To me, contracts and sales are 2 different subjects. Can you elaborate?

Q4) Kingsmen IPO price is S$0.30. We are now trading at S$0.155. While I understand we are not able to control the share price, may I know, going forward, what the company will be doing to increase shareholders' value? The S$0.01 dividend helps but some of us are still a long way from why they had invested into Kingsmen in the first place.

Thank you for taking the time to look into these questions.

Richchee

An investor

Q1A

It is still too early to tell if we would be awarded the official contract for Asian Aerospace ("AA"). We believe that there will be opportunities for us to be involved in AA in many areas based on our track record and relationship with several major exhibitors.

For FY2004, the revenue for AA accounted for approximately 8% of the Group's total revenue.

Q1B

Sorry, it is still too premature to discuss this matter.

Q2

We expect a better year for FY2006 with a targeted revenue growth of 10% to 20%.

Q3

In our recent announcement posted on 10th April 2006, we have disclosed that the confirmed contracts/sales achieved as at 31st March 2006 amounted to approximately S$30.1 million for the financial year ending 31 December 2006 ("FY2006").

The S$30.1 million includes all contracts which were clinched/signed as at 31st March 2006, for jobs to be completed during the year ending 31st December 2006, including those jobs which were already completed and billed in Q1 of FY2006.

Q4

It is our aim to work on our operating fundamentals by improving efficiency and profitability. We believe that strong fundamentals will ultimately improve our profits and hopefully translate into increase in share price.

We will also continue to maintain our dividend payout from a significant portion of annual earnings.

Warmest regards,

The Management Team

Kingsmen Creatives Ltd

|

|

Dear Leo, you wrote:

1. Which segment grows faster this year? Exhibition or interiors? Which business segment contributed more to the revenue achieved in the 1Q reported.

2. Which business segment has higher profit margin?

3. How is the latest released & Confirmed Contracts/Sales Achieved & calculated? How it is calculated compared to the revenue in the P/L statement?

Thanks

Q1

We are expecting faster growth in our Interiors division for FY06 due to some of the major roll-out programs that we have undertaken. We also expect good performance for our Exhibitions division this year based on our Q106 management accounts.

Q2

In terms of gross profit, Design division has the highest gross profit margin, followed by Integrated Marketing Communications division, Exhibitions and Museums divisions, and Interiors division.

In terms of operating profit, Exhibitions and Museums division has the highest operating profit margin, followed by Design divisions, Interiors division, and Integrated Marketing Communications division.

Q3

Please refer to our reply to Mr Rich Chee (Q3)

Warmest regards,

The Management Team

Kingsmen Creatives Ltd

|

|

Dear Anshuman, you wrote:

Dear Management,

It feels good to be a small shareholder of Kingsmen with all the recent good news coming out viz. the 2005 annual results, Q12006 order book announcement, increased dividend for 2005.

However I do feel a little concerned about the following and would appreciate your inputs on the same:

1. Provision for doubtful debts showed a 79% jump to S$436,000 in 2005. This is almost 20% of the total net profit for 2005. What are the reasons for this jump and what is the status of these doubtful debts as on date.

2. Director's remuneration and fees for 2005 was S$3.283 mil which is 150% of the reported net profit of S$2.192 mil. This is something which is extremely odd and does not look too shareholder-oriented. I am really unable to understand why the directors are being paid 1.5 times the profitability of the whole company. It would perhaps be a better idea to reward them with stock options thus aligning their interests better with those of the shareholders.

3. The liquidity in the stock of Kingsmen is extremely low leading to the current low valuations in a very bullish market. Please let us know what are management's plans to increase the liquidity of the stock.

Looking forward to an even better 2006.

Best Wishes,

Anshuman

Q1

The increase in provision for doubtful debts this year is mainly due to two debtors that had become insolvent. Our group's accounting policy for doubtful debts is to make specific provision for those debts identified with recoverability problem. As at 31 December 2005, we have performed a debt recovery assessment on the Group's trade receivables.

The group will continue to monitor its credit risk exposure on an ongoing basis, with specific focus on credit monitoring and collections to minimise future bad and doubtful debts, wherever possible.

Q2

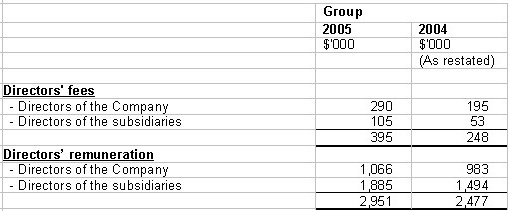

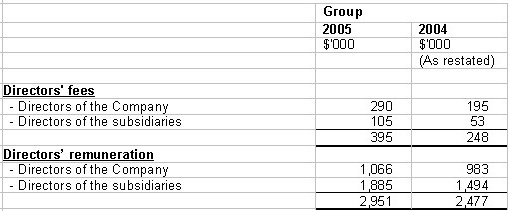

As disclosed in our Annual Report 05, directors' remuneration is comprised of the following:-

The directors' remuneration paid to the directors of the company are those paid to the three (3) executive directors of the company.

The directors' remuneration paid to the directors of the subsidiaries are those paid to a total of sixteen (16) appointed directors of the subsidiaries. These directors are paid a fixed salary, bonus, directors' fees and a profit sharing incentive.

Ours is a professional service business. These directors are actually functioning as senior managers and they are the driving force of our Group. Please be advised that they are totally involved in the day-to-day running of the business and therefore their remuneration packages commensurate with the nature of their duties.

Q3

Please refer to our reply to Ms Joanne Lee.

Warmest regards,

The Management Team

Kingsmen Creatives Ltd

|

Dear Investors,

Thank you for all your questions and the interest in Kingsmen. We have come to the end of this Q&A session.

We have enjoyed and learnt much from your questions and we hope that you have a better insight of our Company and know more about our operations.

Regards.

The Management Team

Kingsmen Creatives Ltd

|